Posts by Capital Advisory Group Inc

YOU CAN’T DEDUCT THAT GOLF GAME

But There Are Plenty of Other Ways to Make the Most of Your Taxes Sad news for anyone whose favorite part of the day is their business meeting on the green: The new tax bill eliminated your opportunity to deduct a golf game as a business expense. As writer Josh Sens shares in a Golf.com…

Read More22 ways to celebrate National Goof Off Day

Happy Goof Off Day, everyone! Today is the perfect day to get crazy and loosen up. We spend so much time being stressed, whether it’s at the office, in school, at home or in traffic. So today is the day to forget your problems and just laugh a little. Call in sick to work, or if you’re…

Read MoreEmployee Appreciation Day

Today is Employee Appreciation Day – Here are 5 ways you can show your Appreciation. 1. Upgrade Office Furniture – Providing your staff with ergonomic office furniture is a great way to ward off possible back problems and improve productivity. 2. Housecleaning – Arrange for a bulk discount at a local housecleaning agency, and give…

Read MoreDocuments to Keep in Business

How long do I keep that? Since many common business documents must be retained in accordance with federal law, here is a list of how long common documents must be kept. 2 Years General Correspondence Bank Reconciliations 3 Years Employee Applications Purchase orders Requisitions Sales Contracts Sales Invoices 4 Years Expired Policies (All types) Settled…

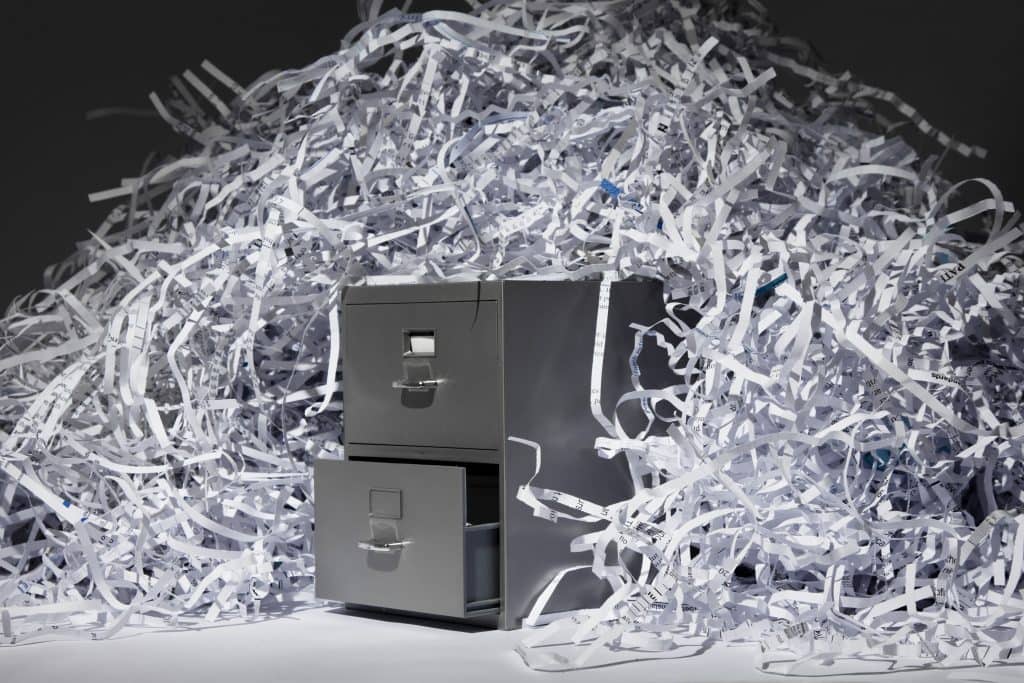

Read MoreSHRED

8th Annual Shred the Clutter Event Saturday, April 18, 2020 10 am – 12:30 Location: 119 Old State RoadEllisville, MO 63021 Sensitive Material That can be Destroyed Purchase Orders Supplier Records Supplier Confidential Information Corporate Records Requisitions Sales Contracts Sales Invoices Customer Lists and Contacts Strategies Advertising Activity Sheets Training Information Contracts Budgets Strategic Reports…

Read MoreHow long do I keep that? Declutter your file cabinet

Every year do you look at your file cabinet and wonder how long should you keep this document? The guide below will help you determine how long each document should be kept. This is not a complete list, if you have questions on a certain document, consult your tax advisor. Documents to Keep ‘Til the…

Read More

Businesses Get New Tax Credit

Business Get New Tax Credit for Employees Family or Medical Leave For businesses who provide paid family or medical leave to employees, a new credit is available under the new Tax and Jobs Act. The new credit is generally equal to 12.5% of the amount of wages paid during the time of leave but…

Read MoreSmall Business Owners Benefit from Boost to Retirement Planning Strategy

Tax Cuts and Jobs Act (TCJA) was signed into law by President Trump in December 2017. While the TCJA affects almost every single individual taxpayer to some degree, the changes also significantly affect corporations and small businesses. In some areas, the impact was purposeful and directed. However, in other ways, the TCJA will have both…

Read MoreTax Planning Services in Ellisville, MO

You may be asking yourself why should I choose Capital Advisory Group? We are focused on delivering quality services to the growing population of small businesses and residents in the area. Capital Advisory Group is a highly trained and experienced team of tax professionals specializing in a wide range of services. We are proud to…

Read More