Tax

Documents to Keep in Business

How long do I keep that? Since many common business documents must be retained in accordance with federal law, here is a list of how long common documents must be kept. 2 Years General Correspondence Bank Reconciliations 3 Years Employee Applications Purchase orders Requisitions Sales Contracts Sales Invoices 4 Years Expired Policies (All types) Settled…

Read MoreSHRED

8th Annual Shred the Clutter Event Saturday, April 18, 2020 10 am – 12:30 Location: 119 Old State RoadEllisville, MO 63021 Sensitive Material That can be Destroyed Purchase Orders Supplier Records Supplier Confidential Information Corporate Records Requisitions Sales Contracts Sales Invoices Customer Lists and Contacts Strategies Advertising Activity Sheets Training Information Contracts Budgets Strategic Reports…

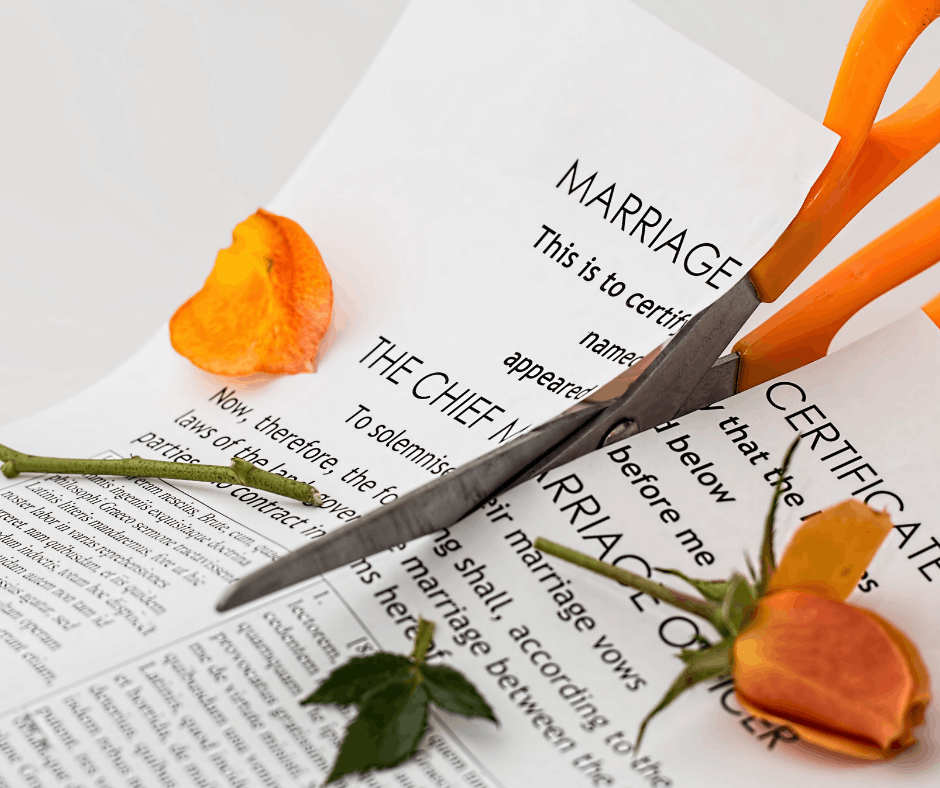

Read MoreDivorce Monday and The New Tax Law 2019

Today is known as Divorce Monday, according to a recent survey by the law firm Irwin Mitchell Solicitors, which found that divorce filings jump by nearly one-third following the holidays. Alimony paid will no longer be tax-deductible and alimony received will no longer be taxable income. For decades, alimony — typically paid by men —…

Read MoreIRS2Go is the official mobile app of the IRS

You may not know that the IRS now has an app. You can get the app here. With the IRS2Go App you can Check Refund Status or Make a Payment. Refund Status Check the status of your federal income tax refund using IRS2Go. You can check your refund status within 24 hours after we receive…

Read MoreTaxpayers should check out these helpful tax tools

IRS Tax Tip 2018-139, September 6, 2018 Questions about taxes could come up any time of the year. Whether it’s about tracking a refund or paying a bill, taxpayers can find answers to their questions on IRS.gov. Here are some of the most popular IRS tools: IRS Free File. Taxpayers who filed an extension can use IRS…

Read MoreRetirees with pension income should do a Paycheck Checkup ASAP

Retirees with pension income should do a Paycheck Checkup ASAP IRS Tax Reform Tax Tip 2018-143 September 13, 2018 Retirees should do a Paycheck Checkup to make sure they are paying enough tax during the year by using the Withholding Calculator, available on IRS.gov. The Tax Cuts and Jobs Act, enacted in December…

Read MoreTaxpayers should find out if they need to make estimated or additional tax payments

Taxpayers should find out if they need to make estimated or additional tax payments IRS Tax Reform Tax Tip 2018-142 September 12, 2018 The U.S. tax system operates on a pay-as-you-go basis. This means that taxpayers need to pay most of their tax during the year, as the income is earned or received. Taxpayers…

Read MoreEmployees with other sources of income should do a Paycheck Checkup

IRS Tax Reform Tax Tip 2018-141 September 11, 2018 The IRS urges everyone who works as an employee and who also has income from other sources to perform a Paycheck Checkup now. For example, certain individuals often need to pay estimated or additional tax. This includes taxpayers who have certain types of income from…

Read MoreHere’s how and when to pay estimated taxes

IRS Tax Reform Tax Tip 2018-140 September 10, 2018 Certain taxpayers must make estimated tax payments throughout the year. Taxpayers must generally pay at least 90 percent of their taxes throughout the year through withholding, estimated tax payments or a combination of the two. If they don’t, they may owe an estimated tax penalty. …

Read More5 Essential Tips for Missouri’s Tax Free Weekend

5 Essential Tips for Missouri’s Tax-Free Weekend Tomorow starts Missouri’s Back-To-School Sales Tax Holiday weekend. This is a time to stock up get everything on your child’s back to school list. If you do not have kids in school or you may not be going back to school yourself this is a great opportunity to…

Read More