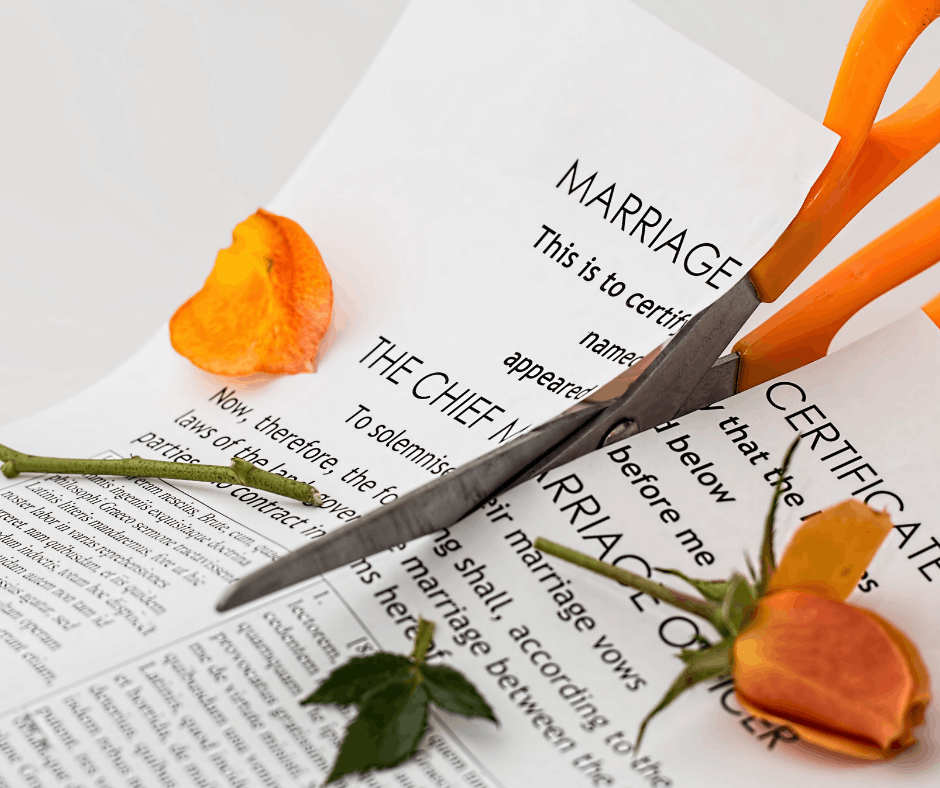

Divorce Monday and The New Tax Law 2019

Today is known as Divorce Monday, according to a recent survey by the law firm Irwin Mitchell Solicitors, which found that divorce filings jump by nearly one-third following the holidays.

Alimony paid will no longer be tax-deductible and alimony received will no longer be taxable income. For decades, alimony — typically paid by men — has been tax deductible for the person paying it and taxable income for the person receiving it (typically women). But that basic tenet of divorce will no longer apply this year and beyond, due to provisions in the big 2017 tax law.

Know the good from the bad. With the new laws, you, your spouse, both attorneys and any financial advisor the two of you will use should be looking at all the angles. Know the good assets from the bad assets, tax-wise.

Since the New Tax Law changes are now in effect it is wise to speak to a tax advisor who can let you know how the changes affect you in 2019.

Capital Advisory Group, Inc. will help you navigate through these changes.

Call (636) 394-5524